Experts:

Tom

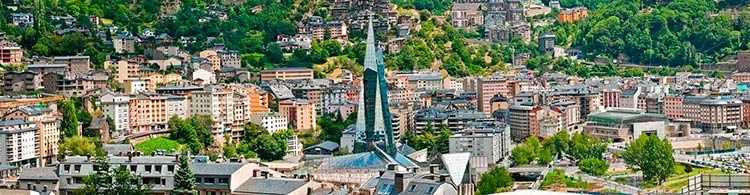

Andorra is one of the most unique places in Europe that consists mostly of captivating landscapes and Romanic architecture, Andorra is a little principality that will surely impress visitors from around the world.

Known as one of the most attractive places in Europe to do business thanks to its low tax rates, Andorra is one of the most colorful and unique places on the Old Continent. It has one of the richest cultures of this part of the world given its proximity to countries such as Spain, France, and Portugal.

This allows people to enjoy a distinctive touristic experience, and for investors this small country offers the possibility of doing business in a business-friendly tax system. In the last few years, Andorra enacted transparent tax legislation with stronger banking compliance rules, which are in line with OECD regulations without sacrificing banking safety. Thus, Andorra is a whitelisted jurisdiction that will still bring you significant benefits.

Companies and Structures

When we hear about Andorra, the first thing that comes to our minds is its famous characteristic of being a country with a beneficial tax system for individuals as well as companies. However, beyond this condition, Andorra offers one of the best environments in the world for the creation or operation of companies within its territory.

One of the examples can be the little and transparent bureaucracy, the digital infrastructure, the geographical location and evidently the quality of life. These are necessary conditions to bring to change the creation of a company within the small country and that allow the creation of value in an effective and legal way of the company that you want to open.

How to Create a Company in Andorra?

The creation of a company in the principality consists of three steps. However, before mentioning them, we must know the type of company we would like to create. In Privatus Maximus we expose the different steps to follow and the different possible types of companies that exist.

Public Limited Company (SA)

This is a type of company that works for the creation of a large company, since its capital is divided among a large number of shareholders that make up the company. The minimum capital to create a corporation is €60,000 and its registration and registration fee is €850.

In the event that a single person wants to opt for this type of structure for his company, then he must create a Sociedad Anónima Unipersonal (SAU).

Limited Company (SL)

This type of structure is recommended for smaller companies, mainly for the commerce or services sectors (one of the largest in the Andorran economy due to the tourist activity). If only one person opts for this type of company, then we speak of SLU (Sociedad Limitada Unipersonal).

The minimum capital required for the creation of the Limited Company is 3,000 euros.

General Partnership

It is an unlimited liability company in which the capital is divided among the partners: the conditions of this statute is a union or integration of the corporation and the limited liability company.

Requirements for the Creation of a Company

To request the corporate name. This procedure is carried out before the Government of Andorra. In it we will request the name that will have our society to create, and the request of the foreign investment is also made. This procedure is carried out as in any other European country. The government facilitates a form to validate the social denomination and thus to obtain a first successful procedure.

Application for foreign investment. This application is made to the Andorran government when the client or clients hold more than 10% of the share capital for the company. It is not necessary for residents. However, it is mandatory if you are a foreigner. In addition to this, a criminal record must be submitted, to prevent any history related to illicit activities.

Bank account and capital stock. After compliance and KYC, a bank account of a company in incorporation must be opened and the share capital must be deposited in it. This requirement is similar to that of any other country, it is a matter of creating a bank account of a company in incorporation and making the actual deposit of the capital. For such procedure we must go to any of the five banking entities in the country, complying with the bank compliance requirements of each entity. Of course, when contacting Privatus Maximus you will be assisted by our experts in this type of procedures.

It is necessary to note that the compliance procedure may also be conditioned by the type of company that is being opened, as well as the condition of the partner or partners.

Public deed and signature before a notary. Execution of the public deed and the articles of association of the company and the incorporation process before a notary. After the signature before the notary, the notary has 20 days to register the company after the signature and incorporation in the Andorran commercial register.

Inscription in the Register of Companies. The notary has 20 working days to register the company after signing and incorporation in the Andorran commercial register. Once signed, the notary registers the public deed and incorporates it in the Register of Companies, thus empowering the company. However, this does not mean the empowerment of the company, since the commercial authorization is still required (a process of approximately one month).

Deposit in the AFA. We will deposit a total amount of €15,000 as a deposit with the corresponding organization and thus obtain the residence permit on our own account. While all the company procedures are being carried out and in order to move forward with the self-employed residence permit, the deposit of the deposit of 15.000€ is made in the Andorran Financial Authority, which will be returned in full after the processing of the cancellation of the permit itself.

NRT and Registry of Commerce and Industry. This procedure and its approval, will allow us to exercise the commercial activity, and we obtain the NRT. All companies that exercise an activity, industrial or of services have to be registered in the registry of commerce. For this moment you must have the address of your company secure and specified.

Inscription in the CASS and other formalities. Finally, we register the company (and members) in the Andorran social security and carry out specific procedures for each company. Finally we would have to register in the Social Security (CASS) the administrators and also their employees if applicable and request some digital files that are very useful for various management tasks in the company. Other formalities are also carried out if required.

The Advantages of Setting Up a Company in Andorra

Labor costs

One of the first advantages to highlight is the lower labor costs compared to countries like Germany or France. The social security charge for companies is 15.5%, while the same charge exceeds 32% in Spain and France. This fact facilitates the hiring of employees and reduces the fixed cost of any entrepreneur setting up a business in Andorra.

Salaries in Andorra

Salaries also offer very competitive figures. The average salary in Andorra is around 2,100 €/month and the minimum salary is 1,083.33 €/month. The latest data extracted from the INE, show how the average salary in Spain is close to the Andorran one, although if we add the difference of the labor cost for the Social Security, it increases up to 12% more than Andorra.

Infrastructures of Andorra

Andorra’s infrastructures are frankly enviable. Communication routes are in full process of improvement, while the country offers 100% fiber optic coverage throughout the territory, while the average coverage in the EU is only 44%. It can be a very attractive destination also for e-commerce YouTubers and remote sales companies from Andorra.

Health System

With a highly qualified medical team and with coverage in other countries thanks to extraterritorial agreements. Likewise, its educational system offers three different models of high quality and free of charge, as well as other options for private and specialized education.

Real estate rental

The cost of renting real estate that can serve as a small office is very economical compared to countries such as France or Spain. The value is around 250€ in a coworking space, a truly affordable price to locate your business office in Andorra and make the most of all the advantages it offers. In addition, municipal charges in the country only amount to less than €800 per year, making it easier to boost the profits of companies established in the Principality.

Substance

When we talk about substance we mainly refer to having a structure in the country, which leads to operating costs for your company. Issues such as salaries and office rents are extremely competitive in Andorra if you compare them with other low tax jurisdictions such as Switzerland, Malta, Ireland or Cyprus.

The minimum salary in Andorra is around €1,120 and office rent is around the minimum cost of only €400 per month. Also, comply with local substance requirements for company models with a special 2% reduction in corporate tax.

If you require qualified personnel, keep in mind that the majority of the population is trilingual and has university education from France and Spain.

Finally, costs related to accounting and auditing, electricity and annual maintenance expenses for your Andorran company are very competitive and at a much lower price level than those of neighboring Spain or France.

On the other hand, substance is the future while offshore companies are slowly disappearing. Obviously the substance comes at a price and has to fit with your business model to work. Andorra may be the best option if you compare it with other jurisdictions within the same European continent. It is necessary to remember that it is not only the country with the lowest corporate tax in the region, but it also has really low structural costs.

Requirements to Maintain Business and Substance

Below we present a series of conditions necessary for the substance of your company in Andorra:

- Registered office must be in Andorra.

- Administrator or employee resident in the territory.

- Prepare quarterly and annual tax returns.

- Pay municipal taxes (800€ per year approx.)

- Real activity with operations and transactions

- At least one employee in the physical office (or premises)

- -Manage operations and decisions from Andorra

- Commercial premises: office, home, offices, etc. (from 400€ per month approx.)

Substance factor in international business

- Physical and registered office (not only postal address)

- Administrative meetings within the Principality

- Main active bank account in Andorra

- Accounting and account management in the country

- Usual operating expenses in Andorra

Banking Services

The banks in Andorra are ranked as part of the world’s top twenty banks. This is in terms of private investment allocation. In Andorra, Banking privacy is a guarantee, and it is, in fact, in the country’s constitution.

Additionally, private numbered accounts and safety deposit boxes are still the norm here. You will find these services in almost all locally owned banks and those that are highly liquid. When we investigated and spoke to one of the banks, we were surprised to note that the liquidity ratio is 30%.

Stability, privacy, and liquidity, however, come at a price. While most banks will not require you to have a minimum deposit, they will charge you a significant annual fee. Nevertheless, this yearly fee gives you access to all the benefits you will be looking for, such as security and banking, specializing significantly in wealth management.

With an Andorran bank, you can manage and access your account from anywhere in the world. Don’t worry, though; they fully comply with the international anti-money laundering standards. They have some of the strictest banking jurisdictions in terms of compliance.

The Principality of Andorra is known for its excellent living standards. This is because natural parks and snowy peaks surround it. Most people who visit this paradise would love to settle there, and if you move here, opening a bank account is one of the most critical steps.

There are many traditional and well-structured banks with a solid foundation, solvency, and high liquidity. These are significant assets, as we have mentioned above.

Here, the banks have the following characteristics, which you need to take into account before embarking on financial investment in the country.

Andorran Banks

Andorran banks are world-renowned for their competitiveness and their high solvency levels. This is essential for the transfer of capital, especially when setting up or creating a new company in the country.

They have some significant players in the financial sphere regardless of multiple challenges. The seven central parishes of the country have ATMs and agencies that represent the five Andorran banks. Generally, they are open to the public from Mondays to Fridays from 9 in the morning till 5 pm.

The agencies are, however, closed over the weekends.

There aren’t too many banks – around five or so.

Here’s what you need to open an account;

- -A valid passport.

- -Proof of address, although this will depend on the bank, you are opening. They mainly will not require a local address.

- -Proof of source of income.

- -CV

- -Referencies

As a non-resident, you can open a bank account. Still, Andorra has tightened the compliance regulations, which means that it may take a bit longer since you will have to provide all of the information needed to comply with the new regulatory standards.

All the banks in the country are full service.

Types of Banks

All banks in Andorra are either classified as national or local. They provide the following services;

- -Consumer banking services.

- -Private banking services

- -Commercial banking services

Generally, the local banks are highly specialized when it comes to wealth management. Their high liquidity levels make them ideal for protecting their client’s wealth.

The banks are accustomed to handling significant clients as well as large-scale operations. They are known worldwide for their logistical support and expertise in financial investments, corporate purchases, and business creation.

Another highlight of these banks is their rigor and efficient customer service. This cultivates close relationships based on trust from investors who wish to grow their capital base using their banking systems.

The Currency

In Andorra, the official currency has been the euro since 2002 when most European countries adopted it. This facilitates investments and trade greatly.

Since 2014, the Principality has issued Andorran euros with the coat of arms of Andorra, the church of Santa Coloma, and Casa de la Vall.

The Solvency Advantage

The solvency of Andorran banks is one of the reasons for their success. Their liquidity/capital ratio far exceeds all the requirements and recommendations.

Their expertise in managing their balance sheet and efficiency in securing financial strategies gives them excellent stability for the internal market and relationships with other countries.

Modernity and Tradition

The banks operate in the strictest form of respect for tradition and private banking. Their immutable workings constitute a renowned system of sophistication, quality, and reliability for financial and monetary councils, which they offer their investors and clients.

The banks work to find solutions that are suitable for long-term, medium-term, and short-term investors, depending on their needs.

Multiple investment options such as mutual funds, traditional savings, and bonds are available in all banks, especially those with a dense banking network.

Turn toPrivatus Maximus’ specialists for available options that we can work out in Andorra; this will significantly reduce the amount of money you lose in conversion. Additionally, you will get a European Virtual Bank that has an IBAN that you can use for sending and receiving money within the EU free of charge.

Residency

Being a little principality between Spain and France, Andorra has become one of the most requested places in Europe for permanent residency. Thanks to its incredible landscapes, colorful culture, political and economic stability, and low tax rates, this principality has seen an increase in the number of people who want to become permanent residents in its territory. The country currently offers various alternatives for such people, so we will summarize all the options that individuals have in order to enjoy all the benefits of being a resident in Andorra.

Before mentioning the alternatives to get residency in the country, it is important to discuss why so many people are interested in becoming permanent residents in this peculiar little principality. These are some of the reasons why more people are looking to become permanent residents in Andorra year after year:

A pleasant climate: for most of the year, Andorra has sunny weather, which will let you enjoy warm days. In winter, you can enjoy the snow and all the activities that the country has to offer at this time of the year (such as various winter sports).

Optimal quality of life: Andorra is amongst the countries with the highest life expectancy and overall quality of life in the entire world. It is currently ranked number 5 in this regard thanks to its top-notch healthcare system, high-level education, and optimal air quality.

Cultural heritage: given its shared history with France and Spain, visitors can find in Andorra a unique blend between these two cultures.

Its Romanic architecture, its colorful traditions, its tasty gastronomy, and its language, are aspects that make Andorra an attractive place for foreign tourists.

Geographical location: Andorra is located between two of the most attractive countries in Europe: France and Spain. Residents from the principality are just hours away from each country, so they might be interested in visiting these countries from time to time. In fact, the country has established travel agreements with the governments of Spain, France, and Portugal, which allows Andorran residents to enter these territories without a visa and stay for 90 days.

Marvelous landscapes: this tiny principality consists mostly of breathtaking landscapes: 90% of the country’s territory is raw nature. This is ideal for people looking to disconnect from the big European metropolis and want to enjoy contact with Mother Nature. It is also perfect for people who enjoy trekking, as they can go through all the country in less than a day. They may be tempted to explore all the rivers, mountains, and forests that make Andorra such a beautiful place.

Andorran economy: the economy of the principality has seen exponential growth in the past decades. Thanks to its thriving touristic industry, its agricultural products, as well as the incentives promoted by the government to attract foreign investors, Andorra’s economy has been growing ever since the ’90s.

Tax system: this is, perhaps Andorra’s most known attribute. The country has some of the lowest tax rates in all of Europe. Its general VAT is just about 4.5% (the lowest in Europe) and, for some goods and services, VAT can be reduced to only 1%. Plus, it has a 10% income and corporate tax rate.

This is just a taste of all the benefits that Andorran residents can enjoy in the principality, which attracts investors from every part of the world to run their businesses in the country. People from more than 100 countries are coming to Andorra looking for a new place to establish their economic activities or just settle in the principality and enjoy the country’s quietness.

If you are looking to obtain your permanent residency here, Andorra’s government offers two different possibilities to do so: as a passive or active resident. We will summarize the benefits and characteristics of each option. However, it should be noted that both alternatives allow its beneficiaries to enjoy these rights:

- Own properties.

- Open bank accounts.

- Operate financially without limits.

- Visa-free access for 90 days to Portugal, France, and Spain.

- Own and run your business in the country, and others.

Now, let’s take a look at each alternative, considering its characteristics, benefits, and requirements in order to obtain your permanent resident status in Andorra.

Passive Residency in Andorra

This kind of residence is the ideal alternative for people that just want to stay in the country while earning income abroad. It is the perfect option for individuals who want to enjoy all the benefits of being an Andorran citizen while making a profit from their business in a foreign country.

Furthermore, this alternative requires its holders to stay in the country at least 90 days a year, which is less than most countries demand to individuals that want to become residents in any given territory. Moreover, if you have a business or personal interest in Spain, France, or Portugal, you can go there as many times as you want per year as long as you don’t stay more than 90 days per visit and stay at least 90 days in Andorra to keep your residency.

This type of residency does not allow its holders to work in Andorra; however, people can open a company with this permission. People that want to apply for this kind of permanent residency must meet some requirements to gain this status:

- Individuals must own or rent a property in Andorra.

- Applicants must invest in a property or company in the country, whose value is at least 400.000 Euros.

- Medical certificate granted by Andorra’s migration authority.

- Deposit 50.000 Euros to the Andorran Financial Authority (plus 10.000 Euros for each family member included in the application). This is deducted from the money invested in the company or property mentioned above.

- Your income outside Andorra must be three times more than the minimum wage in the country. For each family member or dependant, it is required to add 100% more.

Active Residency in Andorra

This alternative allows people to work in Andorra while enjoying all the benefits of living in this little country. This option has two variants that individuals can apply to:

- First, there is the option to obtain an active residency as an employer hired by a national company.

- On the other hand, people can become active residents as owners of their own company.

Regardless of the option you may apply for, each of these alternatives will allow you to enjoy your life as an Andorran resident while making a profit in the principality. This status requires that its holders remain in Andorra for at least 183 days a year. If you are applying for this kind of residency as an employee of a national company, most probably, that entity will take care of all the procedures to help you obtain permanent resident status. However, if you are looking to establish your own company to obtain your residency, Andorra’s government requires that individuals own at least 10% of the company shares and have a managerial position within the business.

If you are looking to obtain permanent residency in the country, you must present certain information to Andorra’s Migratory Authority to comply with the government’s process. These documents are required for people that apply for active or passive residency:

- a clear criminal record;

- establishing your tax domicile in Andorra;

- a certificate of the rental or purchase of a property in the country;

- a contribution to Andorran Social Security;

- a photocopy of your passport;

- a marriage certificate if necessary.

- a certificate of your income.

- an insurance policy for incapacity or medical expenses.

Each of these documents must be certified and translated into Spanish, French, or Catalan. It should be noted that the country’s migratory authorities can ask for other documents if they consider it necessary for a specific individual. The country’s government grants this residency permit for a year the first time the individual applies for it; after that, each renewal extends the permit for three years; finally, each renewal grants a ten-year extension of each renewal in the seventh year of the residency.

What can we do for you?

If you are looking to become a resident in Andorra, we can help you through all the processes, making it easy for you to enjoy the benefits that come with living in this colorful and peaceful country.

We at Privatus Maximus have over 25 years of experience helping HNWI become residents in first-level jurisdictions where they can enjoy excellent life quality and optimize their taxes. Andorra checks both boxes, and it will give you almost unrestricted access to Portugal, France, and Spain.

Furthermore, we work with top-level immigration experts in Andorra who have helped individuals from all over the world receive passive or active residency. They can help you choose an adequate property for your investment and guide you in every step of the journey. Thus, the process can be conducted swiftly so that you can live and thrive in this gorgeous principality. Contact us right now and we will give you all the information.

An Expat’s Life

Living in Andorra is a beautiful experience, as the country is filled with endless activities and excellent views for you to see. This is actually the tip of the iceberg, as it is one of those countries that everyone needs to visit at least once in their lives.

If you are planning on relocating to this country, you must be wondering how life will be. First of all, this is a pretty safe country, and in fact, it has been classified as one of the safest countries worldwide. There are only two roads that can get you out of the country, which are both patrolled at the borders, and there is no airport.

It is so safe that people constantly leave their vehicles running all the time to run errands. So, let’s have a look at what to expect as an Expat living in Andorra.

Cost of Living

Living in Andorra is at par with most other Spanish cities like Madrid and Barcelona, especially on transportation, accommodation, utilities, and food. The cost of living here is 30% below what you are likely to expect in major cities of the world.

Here are some estimates on living expenses in Andorra;

- -A two-bed and one-bath apartment in La Massana costs between €650 and €850 a month, with storage and a car park. This apartment is around 80 m².

- -Andorra has the lowest gas prices in the whole of Europe; they charge €1.20/liter.

- -Internet – the internet speed in Andorra is at 300 Mbps and costs €39/month.

- -Utilities for a two-bed apartment costs €80/month.

- -A standard meal costs between €8 and €15.

- -Coffee costs about €1.20

- -Membership for the gym, sauna, and pool costs approximately €40 per month.

- -Bike park year-round membership or ski pass costs €180.

- Taxes in Andorra

This is yet another benefit of living in Andorra. People do say that Andorra is a sort of Tax haven. Of course, this is not 100% true, but their tax laws are much better than other countries. Some highlights;

- -For married couples that earn up to €40,000 before tax, they are charged a maximum of 10% on the income.

- -Andorra does not have any sales tax, and its VAT is at 4.5%

- -For entrepreneurs who would wish to start a company, the corporate tax rate is at 10%

- -No gift tax.

- -No wealth tax.

- -No payment of inheritance tax.

- -The Capital gains tax – between 0 and 15%

- -Selling within the first year – 15%

- -Selling in the second year – 13%

- -Selling in the third year – 10%

- -Selling in the fourth year – 9%

- -There is a 1% decrease each year from four years and onwards, which means that the property is tax-free and capital gains after about 12 years.

The Internet

It is important to mention the internet in Andorra, and this is because it is super-fast and every home and office in Andorra has internet.

According to a previous update from Andorra Telecom, there were 5,000 offices and 30,000 homes in the country with upgraded modems as of 2018. The average internet speed is up to 285 Mbps.

Healthcare System

In Andorra, the Healthcare is pretty advanced, and the ratio of residents to physicians is 3.6:1,000, meaning that there are 3.6 doctors for every 1,000 residents.

They also have many different medical services offered locally, but the best part of this country is that it is integrated into neighboring countries such as Spain and France.

As per a 2017 publication by Lancet, Andorra is one of the best countries globally in terms of access and quality of Healthcare. It is ranked better than other countries such as Australia, Norway, and Switzerland. These are world-renowned for their progressiveness.

The Main Health Insurance – Caixa Andorrana De Seguretat Social – CASS covers most of the healthcare costs. Some of what this covers includes;

-90% of hospital visits

-100% of childbirth costs.

-75% of dental and medical appointments

The Andorrans wishing to travel to Spain, France, or Portugal must notify CASS of this intention, plus any unexpected medical costs that are likely to arise during their visit, so they can be covered.

Outdoor Activities to Enjoy While In Andorra

While in this country, here are some ideas for the weekends;\

-Hiking – You can hike all over the country, and people regularly go on Lunch loops, where they get to see some amazing views that mostly cost thousands in other countries.

-Skiing – in Andorra, there are several ski companies and lots of bike parks.

-If you love road cycling, you will find the perfect places to train in Andorra, and many pro-cyclists live here.

-There is a company called – Festa Majors, which brings parties to each village all over the country.

-Booze is duty-free, which means that prices are pretty low.

-There are always events in this country, which should keep you pretty entertained and busy.

-Almost all the houses in the entire country feature amazing views.

-This is one of the healthiest countries in the world.

-If you wish to visit a big city like Barcelona, a bus charges only EUR15.

-There is a wide mix of technology, old villages, and the countryside, plus if you decide to take a walk, you will see horses grazing, tobacco fields, modern apartments, old town buildings, fiat pandas, tractors, amazing cars, free Wi-Fi, among other interesting things.

The Andorran People

The kind of people you will meet here are from all walks of life, but of course, there are the “Andorran Locals,” who have families and have lived here for centuries.

These people emigrated from Spain, France, and Portugal, and a few may have come from Great Britain. Currently, most of the expats are from America, Eastern Europe, and the Philippines.

Some came to work for higher salaries, and some were just perpetual travelers enjoying the country. They spend their time hiking, skiing, cycling, and learning new ways of living.

Some people are super rich with lots of money, while others are happy to just own what they have in their backpacks and spend their summers enjoying the country.

The good news is that they are super friendly, and everyone always has a funny story for you.

A Few Things Might Make You Feel Disconnected

You may feel like this country is a little behind for someone accustomed to the big cities and a big way of life where Amazon delivers everything.

Some online retailers do not even include Andorra in their list of countries they will ship products to.

There is, of course, always a way around any of these hassles. For example, you could get your parcels sent to a shop on the border at La Seu d’Urgell, and it is always wise to learn about these small annoyances before settling here.

- Government Agencies

Having decided to set up business in Andorra or get Andorran residency, a foreign Investor might need the following government agencies, so they will come in handy.

Ministry of Foreign Affairs This department is responsible for all foreign legislation, especially for foreign investors. They deal with;

-Legislation of documents

-International organizations

-International Cooperation and development.

Included are the following departments;

-Department of Cooperation (Direccio d’Afers Multilaterals I Cooperacio),

-Department of Bilateral and Consular Affairs (Direccio d’Afers Bilaterals I Consulars);

Ministry of Finance and Public Cooperation The government body is in charge of all financial affairs, here are some of the departments under the ministry;

-Finance Department

-Department of Licenses

-Department of Statistics

-Department of Financial Control

-Department of Corruption Resistance

Ministry of Commerce The Ministry of Commerce encourages economic developments by facilitating entrepreneurship, commerce and a protection of consumers. As a foreign investor, any legislation and regulation of your business will be done in this department.

Investment Promotion Agency It is Andorra’s economic promotion and development agency. Promoting key sectors for the diversification of the economy, attracting and accompanying foreign and local investment, supporting Andorran companies to become more competitive, and facilitating the arrival of new companies in the country.

The Andorran Financial Authority It is the supervisor of the financial, insurance and reinsurance system of the Principality of Andorra. The AFA is a public entity with its own equity, its own legal personality and has full capacity to act both publicly and privately, independently of the General Administration, in order to carry out the functions assigned to it in accordance with those established in the legislation in force.

Statistics Office The body in charge of official statistics is to manage the Andorran statistical system. Through the planning, coordination and regulation of statistical activity, it provides objective, impartial information to public authorities, policymakers, economic and social agents and all other citizens.